Home in a Flood Zone? You Need This Certificate (and It Costs $$$)

Last Updated: December 06, 2023

Fact Checked By: Ryan Maguire

On This Page

In high-risk areas, insurance agents often require an Elevation Certificate (EC) before determining the premium on your flood insurance.

But beyond just insurance purposes, a flood elevation certificate is a good way to get a clear picture of how your home or business would be affected in the event of a flood.

Flood Elevation Certificate Survey Cost #

Hiring a surveyor for a flood elevation certificate (FEMA Form 086-0-33) typically costs $400 to $700 on average. Key factors impacting costs:

Region - Surveyor costs more in some markets like coastal areas

Structure Size - Larger square footage increases measurement time

Finished vs Unfinished Areas - More areas to measure raises cost

Complexity - Multi-level homes, complex rooflines add to price

Ease of Access - Crawl spaces vs open basements, ladder required

Always verify licensing, insurance, flood plain mapping expertise and equipment when hiring. Costs range from $350 for a simple one-story up to $800+ for larger, intricate multi-level homes in expensive metros.

Real Flood Elevation Certificate Survey Cost Examples #

"I needed certification for flood insurance on my small, one-story suburban home. A local surveyor charged me $425 to survey and produce the detailed flood elevation certificate." - Amanda T.

"When applying for a rebuild permit after flood damage, FEMA required elevation certification for our large 2-story home. A specialist surveyor charged $675 to measure multiple finished and unfinished areas." - Michael S.

"When purchasing a property in a flood zone, my mortgage lender mandated I get an elevation certificate from a certified surveyor. For the intricate 3-story townhouse measurements and documentation, I paid $850." - Melissa D.

"As a home developer building in a flood plain, I paid a surveying company $5,250 to certify elevation levels across the 5 home sites to comply with county flood ordinances before construction." - Steve W.

As shown, costs to obtain flood elevation certificates range from $400s for simpler, one-story structures up to $800+ for larger, complex multi-level homes.

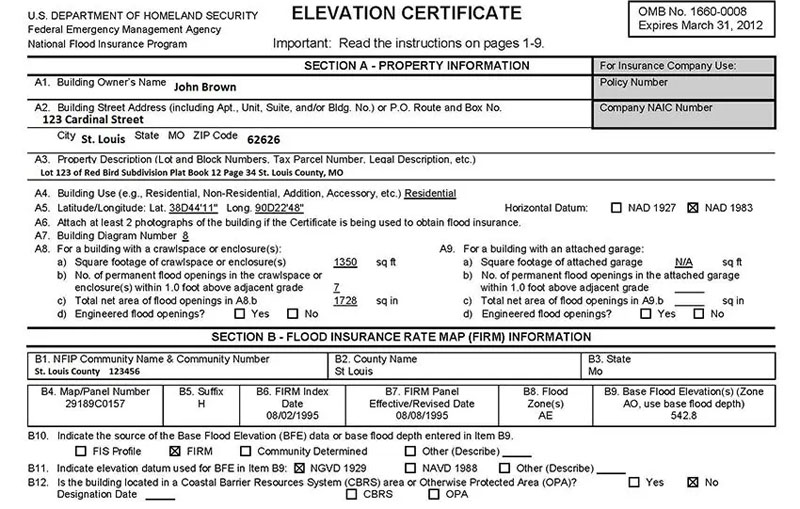

What Is an Elevation Certificate? #

An EC is a document that provides the elevation of your building, ensuring it meets minimum elevation requirements.

The Federal Emergency Management Agency (FEMA) buildings in Special Flood Hazard Areas have the proper elevation and venting needed to minimize flood damage. Elevation Certificates confirm whether a building is compliant with community and local floodplain management ordinances.

Often, communities require that properties get an EC during the permit process. To find out if there is an Elevation Certificate for your property, contact your local floodplain officials or the planning and zoning office.

If there is one, you can get a copy from community officials or the property developer.

A licensed land surveyor, registered architect, or registered professional engineer that is authorized by local or state law to certify elevation information needs to prepare and certify the elevation certificate for it to be valid.

Flood Insurance and Elevation Certificates #

For structures in high-risk areas, it is common for insurers to require an elevation certificate before issuing flood coverage.

The EC has information that is necessary for determining the premium of your flood insurance. It's important to note that, although you buy the policy through your insurer, all flood insurance is provided by the National Flood Insurance Program, which is managed by FEMA.

Your insurance agent compares the elevation of your building to the base flood elevation (BFE) shown on a flood insurance rate map (FIRM) to figure out the cost of covering your flood risk.

Typically, the lower the risk the lower the premium. Zones on a FIRM detail your risk level, with high-risk areas labeled as A or V.

There are some exceptions to this.

If you are eligible for a subsidized rate and your structure was built before your community's first FIRM went into effect (referred to as pre-FIRM), then an elevation certificate is not required for coverage.

It should be noted, though, that annual premium increases are phasing out subsidized rates for pre-FIRM structures. Realistically, an EC is needed to calculate the full-risk rate specific to your property.

You do not need an EC if you are in a moderate- to low-risk area (zones B, C, and X) or undetermined risk areas (zone D). There are also some high-risk areas (such as zones A99 and AR) that qualify for other subsidies and do not need an Elevation Certificate.

Remember that building codes and other requirements change over time, so it is important to research the most up to date regulations.